The “Musk Effect” – How Elon Musk’s tweets affect the cryptocurrency market

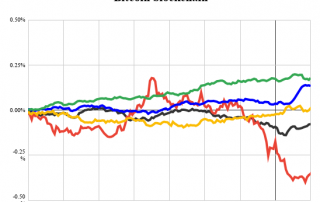

Based on an analysis of Elon Musk's recent crypto-related tweets, it is identified that some of them strongly influenced the short-term returns and trading volume of Bitcoin and Dogecoin. The results illustrate the influence of influential individuals on cryptocurrency markets.