Retail Investors in the Crypto-Metaverse: A New Frontier in Digital Real Estate

The realms of gaming, augmented reality, virtual reality, and real estate have converged into a sophisticated digital ecosystem known as the crypto-metaverse. Empowered by blockchain technologies and underpinned by cryptocurrencies, they enable investors to purchase digital real estate in the form of non-fungible tokens (NFTs) and interact with digital landscapes. The crypto-metaverse transcends mere amusement and has evolved into a robust digital landscape. This new paper reveals the motivations behind why ordinary retail investors purchase metaverse land.

Valuation in a Virtual World

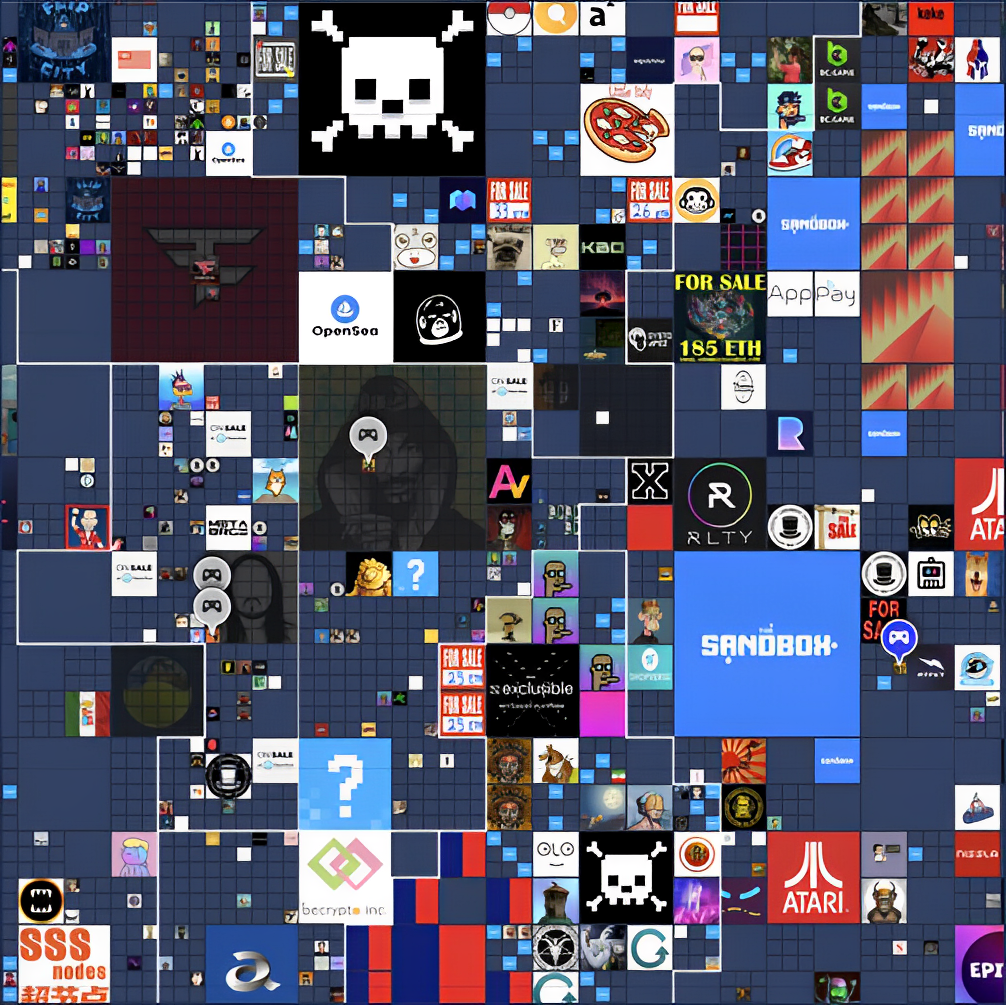

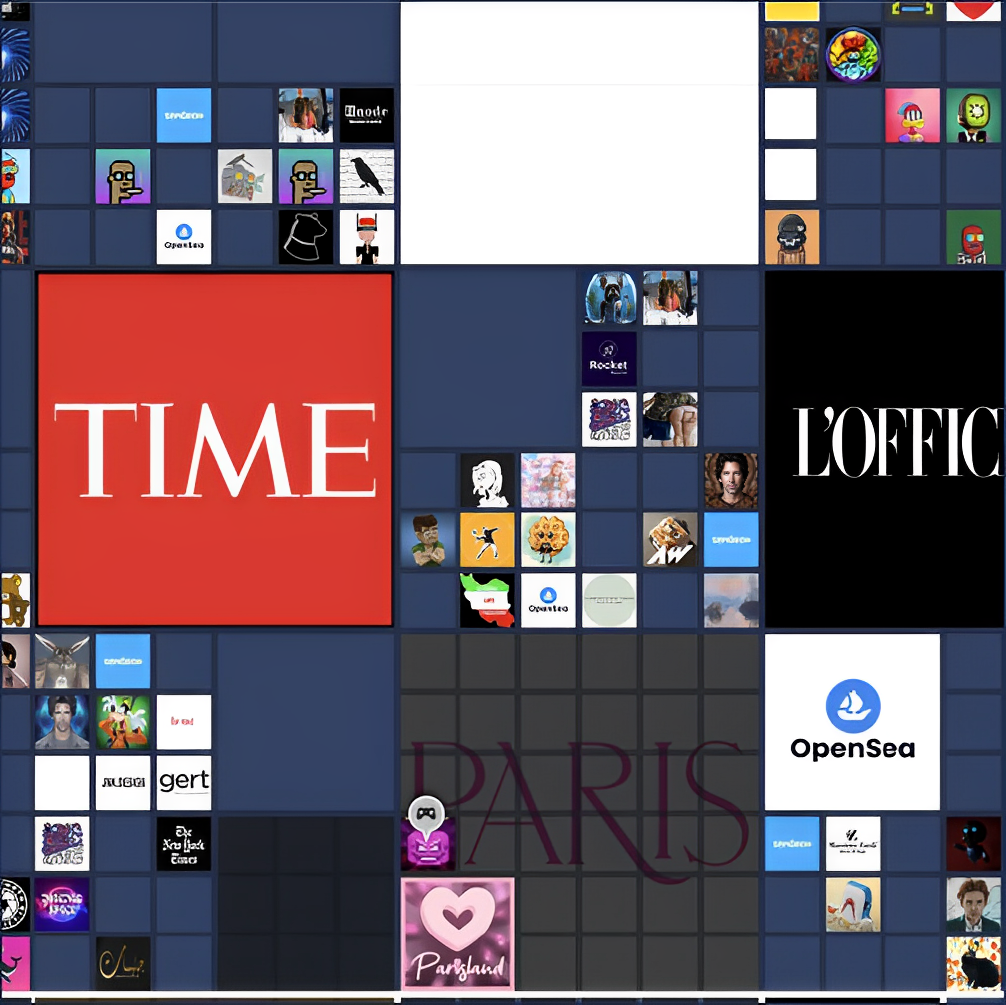

In the rapidly advancing crypto-metaverse, consumers can now engage with brands like never before. Whether shopping for the latest collections at Nike or Gucci in Roblox’s digital stores, enjoying a Snoop Dogg party in The Sandbox, or attending an exclusive Dolce & Gabbana event in Decentraland, the crypto-metaverse has opened new avenues for immersive brand interaction.

The scarcity of digital real estate is comparable to physical property, with valuations echoing this dynamic. In December 2021, an investor paid $450,000 for a plot next to Snoop Dogg’s virtual residence on The Sandbox. A month before, the investment company Republic Realm broke records by paying $4.3 million for a large plot of land on The Sandbox. As in the terrestrial real estate market, location commands a premium in the crypto-metaverse, with proximity to notable landmarks, busy streets, notable addresses, and celebrity neighbors elevating prices.

The scarcity of digital real estate is comparable to physical property, with valuations echoing this dynamic. In December 2021, an investor paid $450,000 for a plot next to Snoop Dogg’s virtual residence on The Sandbox. A month before, the investment company Republic Realm broke records by paying $4.3 million for a large plot of land on The Sandbox. As in the terrestrial real estate market, location commands a premium in the crypto-metaverse, with proximity to notable landmarks, busy streets, notable addresses, and celebrity neighbors elevating prices.

Motivations Behind Virtual Ownership

The allure of the crypto-metaverse has not only captured the imaginations of major companies and wealthy investors but also gained traction among ordinary investors. To investigate this phenomenon, Blockchain Research Lab issued a survey, in collaboration with CoinGecko to explore their motivations: What drives retail investor purchases of metaverse land? Their paper identified four main groups of metaverse land investors:

- Aesthetics & Identity: The crypto-metaverse offers a virtual canvas for self-expression, where individuals can craft their own unique personas. It draws investors attracted to aesthetics, identity, and innovative business models. This group of retail investors transcends mere possession to curation and digital commerce.

- Social & Community: The crypto-metaverse breaks physical barriers and fosters global connections. It attracts investors seeking community engagement, social influence, and the long-term utility of digital real estate. This group of retail investors seeks to forge new interpretations of human connectivity.

- Speculation & Investment: The crypto-metaverse hosts both cautious and daring investors focusing on short-term sales and strategic longer-term goals. To these investors, the metaverse is a digital reboot of traditional real estate. This group of retail investors appeals to those lured by the high-stake risk rewards of investment.

- Innovation & Technology: The crypto-metaverse attracts pioneers in technological innovation and serves as a platform for experimentation and discovery. This group of investors encompasses those captivated by the underlying code, the desire to disrupt traditional systems, and those exploring uncharted digital terrains.

The appeal of digital real estate is diverse, touching on fundamental human desires and needs, from personal expression to community building, and investment strategy to technological innovation, the crypto-metaverse presents opportunities that resonate across different aspects of investor behavior and psychology.

Influences of Age and Education

The paper also reveals a nuanced pattern in investment choices where traditional behaviors find new interpretations:

- Seasoned Investors: Older retail investors are more likely to engage with 2. Social & Community and 4. Innovation and Technology groups. This resonates with longer-term engagement than trend-following.

- Education’s Surprising Role: Those with advanced degrees surprisingly are less likely to be associated with 2. Social & Community.

- Risk-Takers: Retail investors with a propensity for risk naturally align with 3. Speculation and Investment, where bold strategic investment moves are financially rewarded and punished.

- NFT and Aesthetic Enthusiasts: The retail investors that have previously purchased NFTs find greater appeal in 1. Aesthetics & Identity, as they appreciate merging artistic expression with potential value-extraction.

Implications for Stakeholders

The paper has important implications for various stakeholders:

- For Developers: Awareness of what drives metaverse land purchases offers an opportunity to tailor platforms to specific user demographics. Understanding the motivations of investors predisposed to longer-term engagement can improve satisfaction and retention rates on the platforms, helping optimize the platform in a highly competitive landscape.

- For Policymakers: Insights gleaned from retail investor behaviors in the crypto-metaverse can provide a basis for informed regulatory frameworks. This approach fosters growth for a market without tarring all investors with the same brush, allowing the safeguarding of investors at greatest risk, whilst encouraging innovation.

- For Investors: A nuanced understanding of what drives retail investor demand for digital real estate equips financial strategists with the tools to align their portfolios accordingly. Platforms with investors engaged inclined to platform longevity are likely to be lower-risk investments compared to those that attract short-term investors.

Reference: Ante, L., Wazinski, F. P., & Saggu, A. (2023). Digital Real Estate in the Metaverse: An Empirical Analysis of Retail Investor Motivations. Finance Research Letters Vol. 58 Part A, 104299. https://authors.elsevier.com/c/1hbcJ5VD4Kr1Zu