The Rise of ChatGPT: Exploring its Effects on AI-Based Cryptocurrencies

The launch of ChatGPT, an artificial intelligence (AI) chatbot model developed by OpenAI, has generated significant interest worldwide. The model uses reinforcement learning to engage in verbal communication with its users, providing detailed responses and accurate answers to questions. Within a week of its release, the model had accumulated over one million users and was widely discussed on various (social) media platforms. By January 2023, ChatGPT has an estimated 100 million monthly users, making it the fastest-growing consumer application in history.

The widespread adoption and attention towards ChatGPT suggests the presence of significant opportunities within the AI industry, which may also serve as a positive quality signal for AI-themed assets, resulting in positive abnormal price effects. The article „The ChatGPT Effect on AI-themed cryptocurrencies“ study aims to empirically assess if a “ChatGPT effect” on cryptocurrencies with a focus on AI exists.

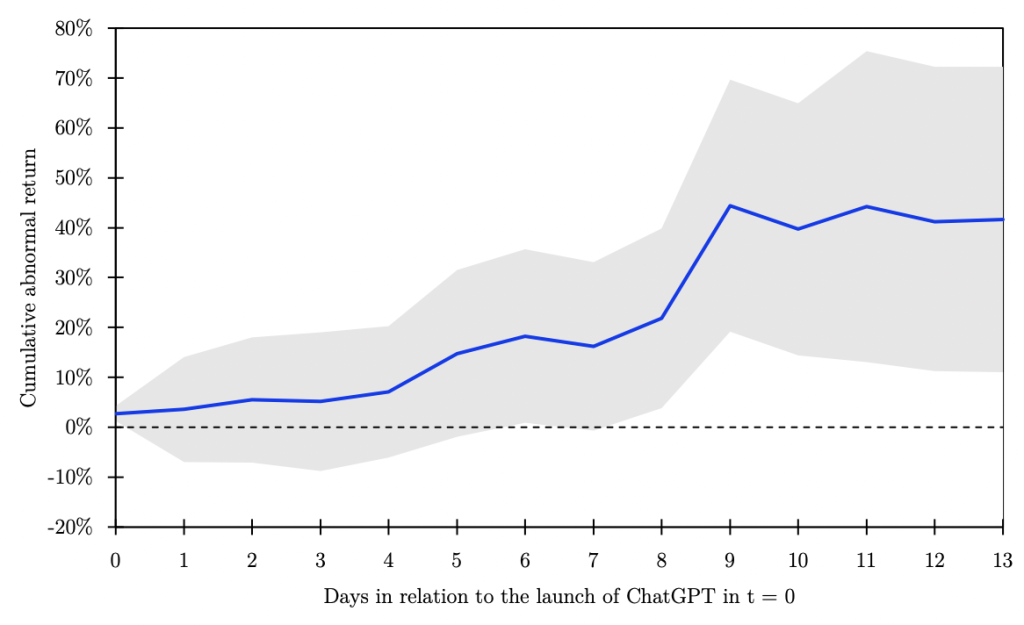

The study by Lennart Ante and Ender Demir used an event study methodology to test semi-strong market efficiency using a sample of 15 AI-themed crypto assets, for which an equally-weighted AI crypto index was calculated. Data was sourced from CoinGecko, a leading crypto market data portal. The study found that 90% of the AI tokens showed positive abnormal returns after the launch of ChatGPT, with an average abnormal return up to 41% over the course of two weeks. These results suggest that the attention towards ChatGPT and AI in general has transitioned to the cryptocurrency market, leading to positive price effects for AI-related cryptocurrencies.

Cumulative abnormal returns of an equally weighted AI crypto index over the two-week period following the launch of ChatGPT. The blue line shows the average cumulative abnormal return and the gray bar shows 95 percent confidence intervals.

The findings of this study contribute to the fields of market efficiency and signaling theory. The study shows how a publicly-perceived “narrative” can influence updated expectations of a particular set of assets and how these expectations are reflected in market reactions. Additionally, the study highlights the potential for the perceived success and potential of a technology to serve as a quality signal for actors in different markets, leading to herding behavior and contagion effects. This highlights the importance of understanding the role of narratives in shaping market expectations and their impact on the efficiency of financial markets.

The full study can be assed using this link: „The ChatGPT Effect on AI-themed cryptocurrencies“