The “Musk Effect”: New research on the impact of Elon Musk’s Twitter activity on cryptocurrency markets

Our short study on the influence of Elon Musk’s Twitter activities on cryptocurrencies such as Bitcoin or Dogecoin, published in February 2021, has led to broad interest in academia and practice. In addition to several thousand downloads of our article, our contribution was followed by invitations for guest posts on the blogs of Duke University and the University of Oxford, as well as numerous mentions in renowned media outlets such as Forbes or Business Insider.

In the meantime, our co-founder Dr. Lennart Ante has published a revised version, based on a sound theoretical foundation as well as an extensive data base, which provides a comprehensive review of the so-called “Musk Effect”.

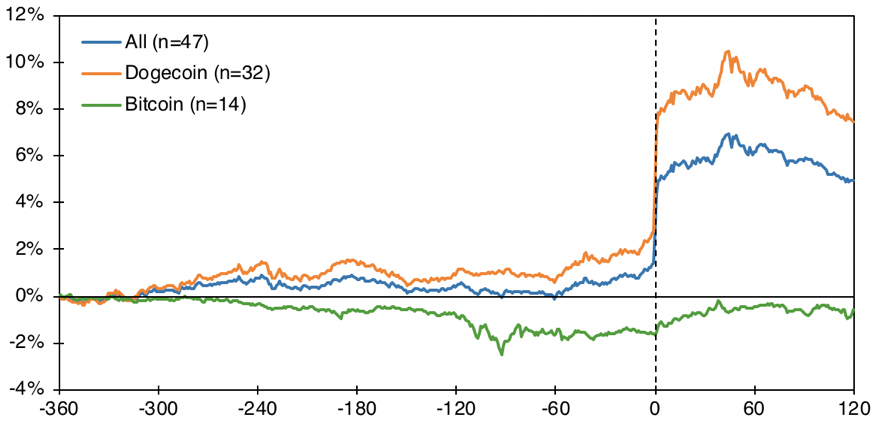

Cumulative log returns of cryptocurrencies around selected tweets by Musk. For example, the orange line shows the return of Dogecoin in the -360 minutes before to 120 minutes after a tweet about Dogecoin by Elon Musk.

Using an event-study approach, the study analyzed the extent to which Musk’s Twitter activities affected cryptocurrency returns and volumes in the short term. Based on a sample of 47 crypto-related Twitter events, significant positive abnormal returns and trading volumes were found following such events. At the same time, price effects were found to be significant on average only for Dogecoin-related tweets, but not for Bitcoin.

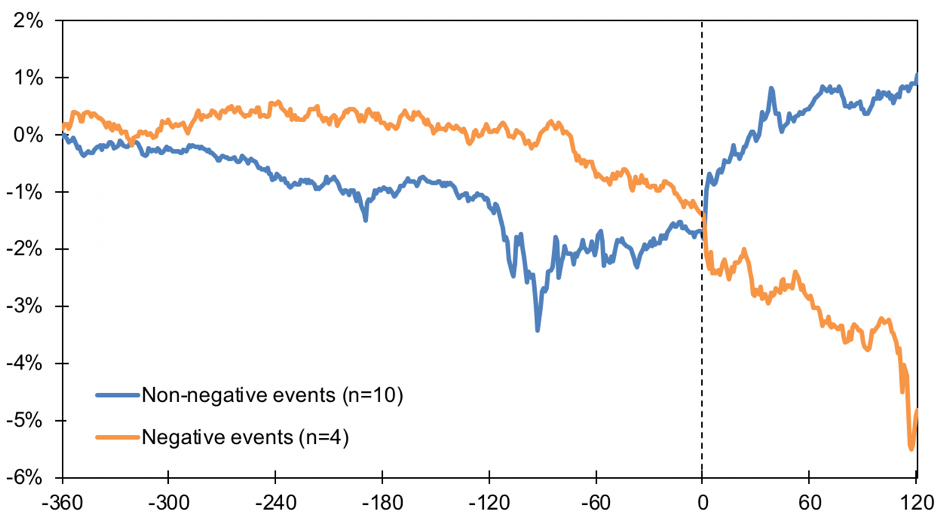

Cumulative log returns of Bitcoin around selected tweets by Musk. For example, the orange line shows tweets classified as negative from -360 minutes before to 120 minutes after a tweet about Bitcoin by Elon Musk.

The rationale for this is that in Bitcoin the significant price effects of positive and negative news cancel each other out, as further classification and analysis of Bitcoin-related tweets showed.

The study shows the significant impact that the social media activity of influential individuals can have on cryptocurrencies. This suggests a conflict between the ideals of free speech, morality, and investor protection.

You can download the full article here.