A Week With Bitcoin: Transaction Timing and Transaction Fees

This blog post is based on the data set analysed in the BRL Working Paper “Dominating OP Returns: The Impact of Omni and Veriblock on Bitcoin” by our researchers Dr. Elias Strehle and Fred Steinmetz. Read the full paper here.

Two earlier blog posts discussed how OP Return transactions have affected the Bitcoin ecosystem. The first blog post considered the overall impact during the sample period from September 14, 2018 until December 31, 2019. Virtually all OP Return transactions were published by two services: Omni/Tether and VeriBlock. Together they accounted for a stunning 21.5% of all Bitcoin transactions. The second blog post considered the impact on a daily basis. Many ups and downs in Bitcoin activity were caused by Omni/Tether or Veriblock, while regular activity on Bitcoin was remarkably stable.

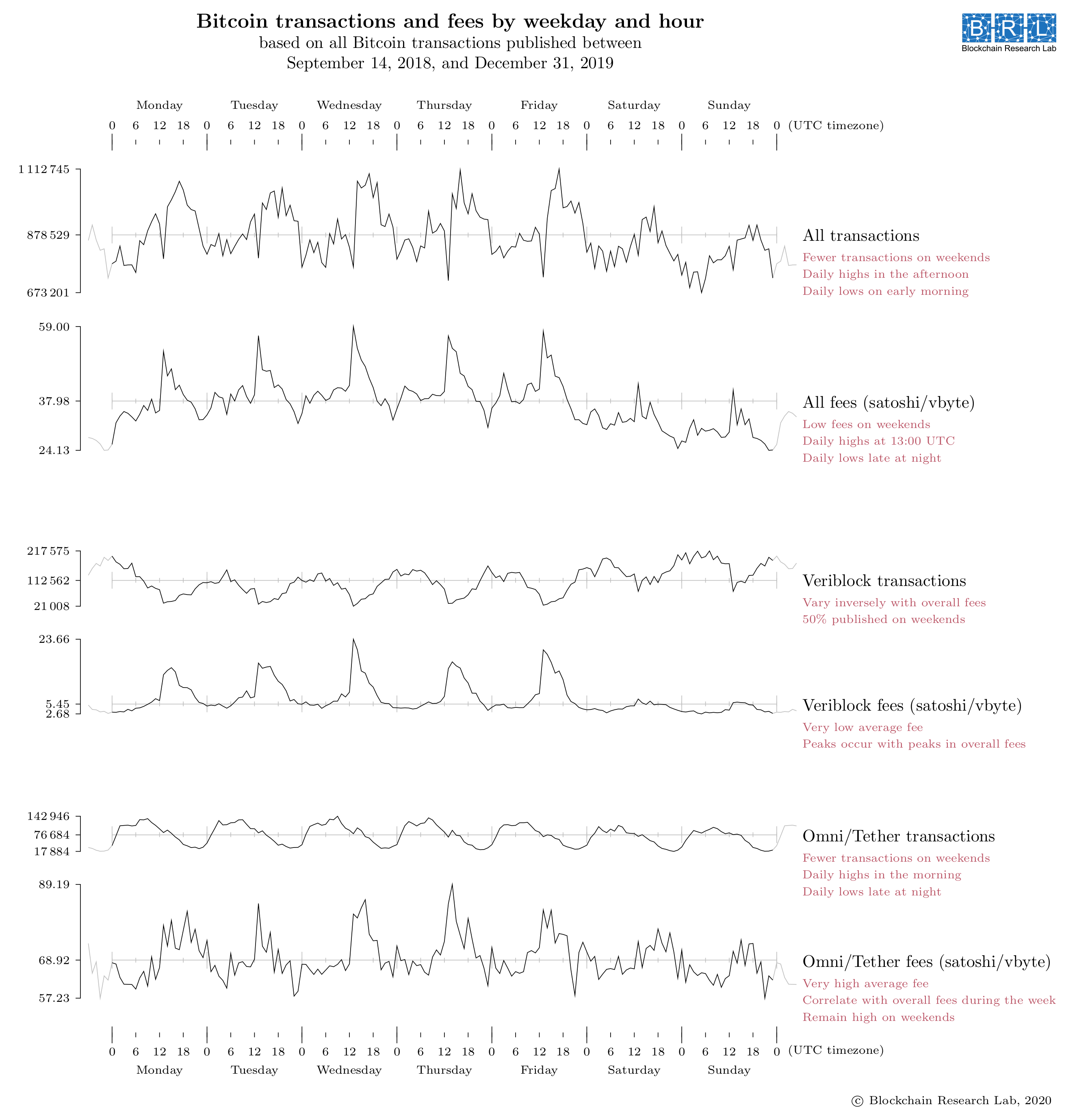

This third and last blog post takes a look at intra-week patterns of Bitcoin activity. The following chart shows transactions and fees aggregated by weekday and hour. Hours are in UTC, i.e. one hour behind Central European Time and two hours behind Central European Summer Time. Fees are denoted in satoshi per virtual byte.

Activity was high on workdays and on afternoons, and low on weekends and on early mornings. The same is true for transaction fees; high activity coincided with high transaction fees and low activity with low transaction fees. This is in line with the economics of Bitcoin. Bitcoin miners generally prefer transactions that offer high transaction fees. High activity means that more transactions compete for inclusion in the next Bitcoin block and users have to offer higher transaction fees. Low activity, on the other hand, means less competition and results in lower transaction fees. One anomaly shows up in the chart: On workdays at 13:00 UTC, activity was unusually low and transaction fees were unusually high.

Veriblock transactions followed a different pattern: Activity is highest on mornings and on weekend. The Veriblock project implements a security mechanism called Proof-of-Proof. A Veriblock user can act as a “Proof-of-Proof miner” by publishing a snapshot of the Veriblock blockchain in an OP Return transaction on Bitcoin. As a compensation, the user receives a mining reward on the Veriblock blockchain in the blockchain’s native currency VBK. In a sense, Veriblock’s Proof-of-Proof miners exchange BTC (in the form of transaction fees on Bitcoin) for VBK (in the form of mining rewards on the Veriblock blockchain). This explains the pattern of Veriblock activity on Bitcoin. Veriblock activity was high whenever overall transaction fees were low, because low transaction fees on Bitcoin result in an optimal “exchange rate” between BTC and VBK for Proof-of-Proof miners.

Tether is a so-called stablecoin. Its value is pegged to the US-Dollar, making it a cryptocurrency with minimal price volatility. Tether is deployed on top of other blockchains; on Bitcoin, it is deployed via the Omni Layer protocol. Omni/Tether transactions mostly follow the pattern of overall activity, with the exception that activity remains high on weekends. The fees paid by Omni/Tether correlate with overall fees, but are almost twice as high. It is unclear why Omni/Tether transactions pay such high fees.

The chart illustrates that transaction timing can have a large impact on transaction fees. Publishing transactions on Bitcoin was very expensive during “rush hour”, i.e. when overall activity was high. Veriblock’s users have demonstrated their capability to avoid these times of high activity, which enabled them to publish millions of transactions at minimal cost. Their behaviour may find wider adoption among Bitcoin users who are able to shift their activity from workdays and afternoons to weekends and early mornings. The potential cost savings from such a shift could be significant.

For more information, read the BRL Working Paper “Dominating OP Returns: The Impact of Omni and Veriblock on Bitcoin” here or contact the authors directly at strehle@blockchainresearchlab.org.