Investigating the Market Reaction to Large Transactions on the Bitcoin Blockchain

This blog post is based on the BRL Working Paper “Market Reaction to Large Transfers on the Bitcoin Blockchain – Do Size and Motive Matter?” by our researchers Lennart Ante and Dr. Ingo Fiedler. Read the full paper here.

A specific feature of the blockchain technology and thus also of the Bitcoin network is the underlying transparency. Each network participant can observe in virtually real time how many and what kind of transactions take place in the Bitcoin network. So, if someone sends out a big amount of Bitcoin, the market recognizes this immediately.

We were interested in the question to what extent this information is recognized as relevant by the market and whether corresponding effects can be observed on secondary markets. If someone transfers Bitcoins worth millions of Euros, this can be intuitively interpreted as a sign of uncertainty. Possibly nothing happens and the Bitcoins lie ‚unused‘ on a new address. However, it is also possible that these Bitcoins are to be sold or have been stolen. Against this background, one can assume that this uncertainty will lead to a short-term negative price effect.

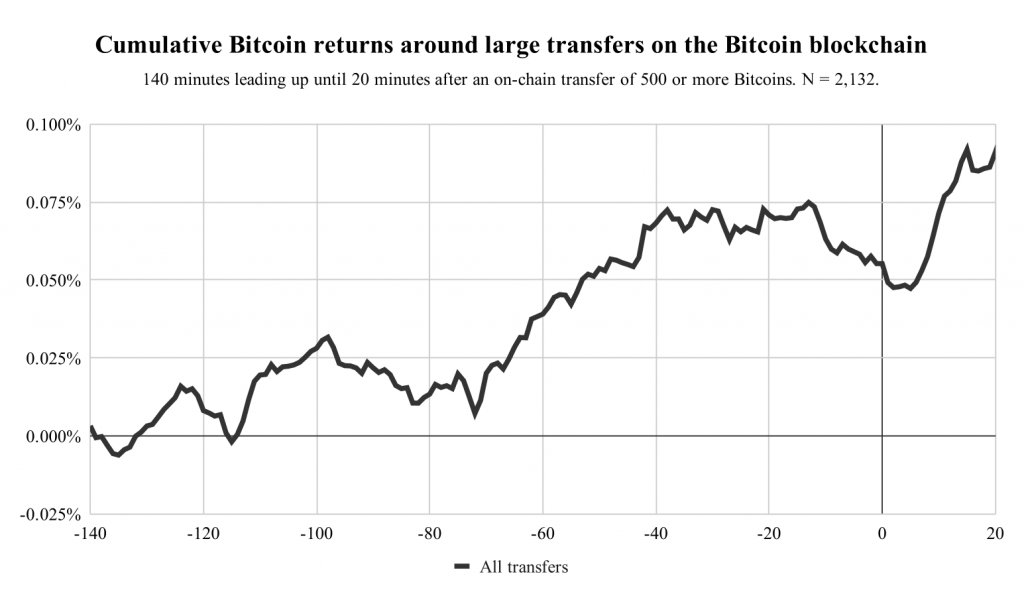

For the purpose of analysis, we identified 2,132 Bitcoin transactions between October 2018 and September 2019 in which at least 500 Bitcoins were transferred. The following graph shows the average price development of the Bitcoin price for 140 minutes before to 20 minutes after the large transactions on the blockchain. We apply event study methodology, a method where the average returns of the past are compared to returns around an event window. If returns in the event window are higher than historic returns, one speaks of abnormal returns, i.e. returns that can be explained by the event.

It can be seen that prices rise until shortly before the time of the transaction, then fall until about 5 minutes after the transaction and finally rise comparatively strongly. This can be taken as an indication that further analysis may be useful. We identify significant negative price effects for the minutes closely around the events and positive effects over the period from the event to 15 minutes thereafter (see the publication for details).

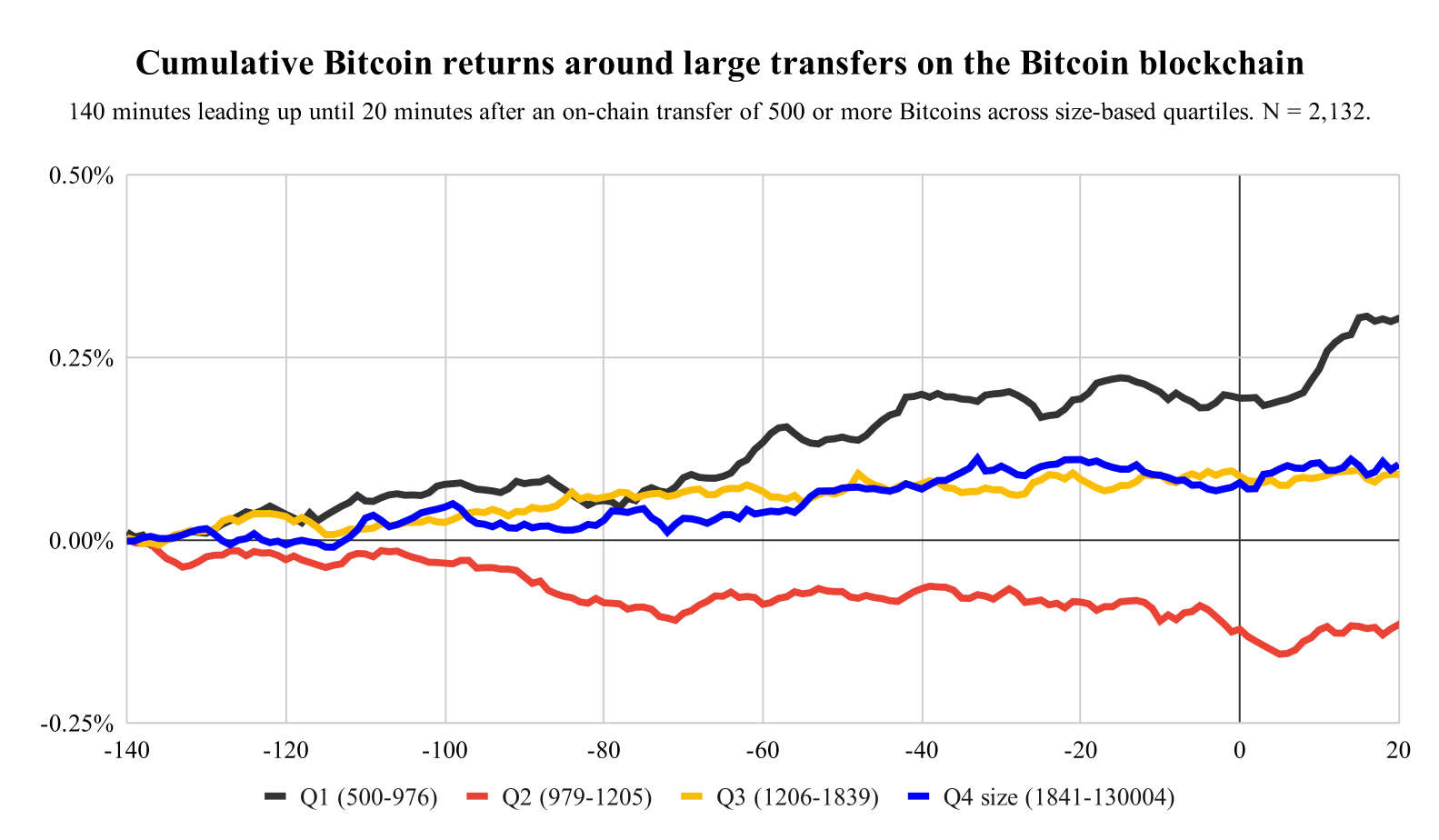

In the next step, we divide the large transactions into four equal-sized groups (quartiles) in order to find out whether effects also increase with increasing size. The following figure shows the price development for the four groups. As one can already assume on the basis of the chart, effects do not scale with increasing size, as the second group shows the lowest returns and the first one the highest. So, there are likely other (additional) reasons for the significant effects.

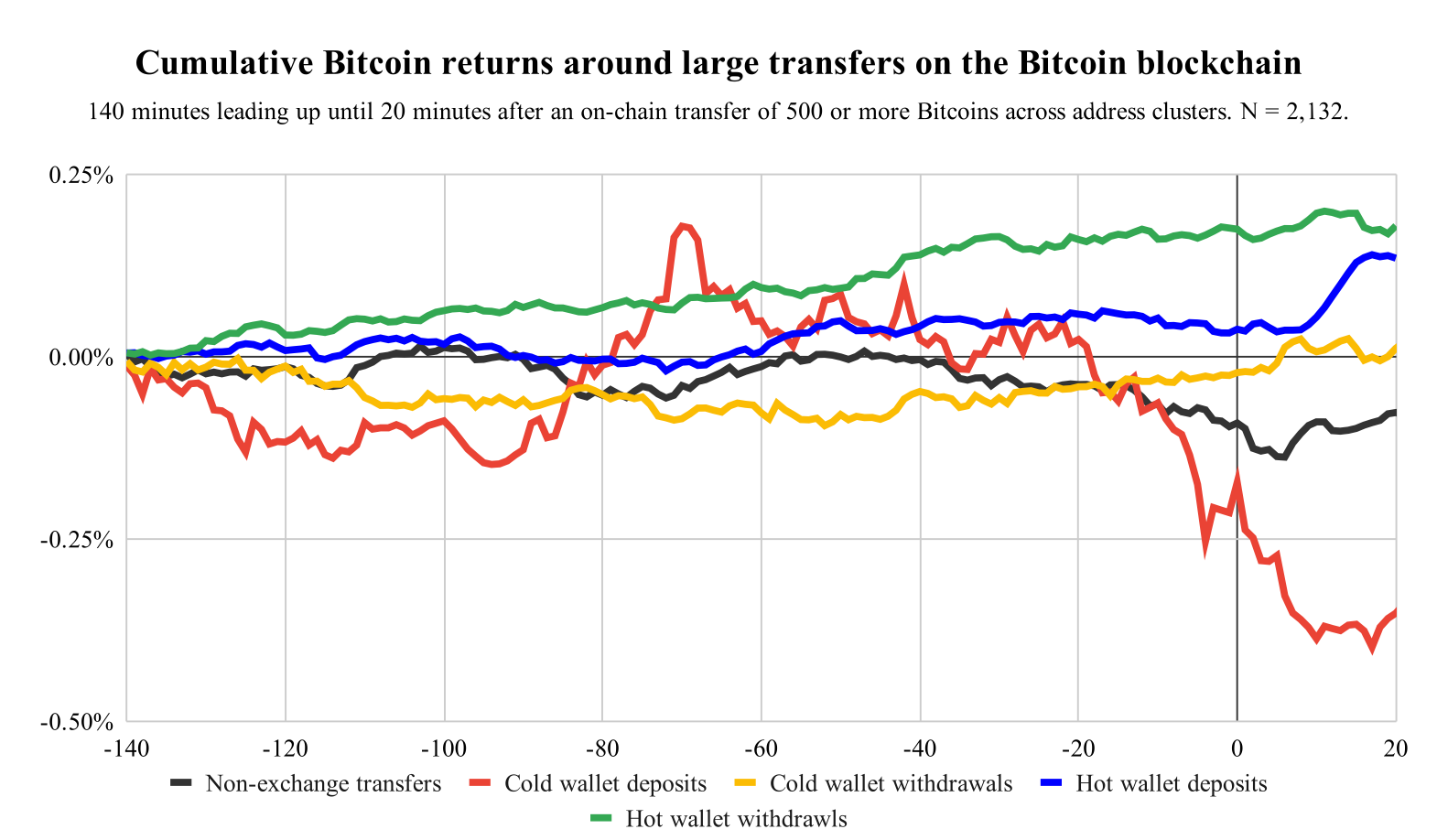

In the next step, we cluster all transactions based on five categories:

- Non-exchange related transfers (20%)

- Cold wallet deposits (2%)

- Cold wallet withdrawals (6%)

- Hot wallet deposits (27%)

- Hot wallet withdrawals (43%)

For example, the market may interpret transactions that are sent to a deposit address of a cryptocurrency exchange different than a transaction that is withdrawn from a cryptocurrency exchange, as assumed motives differ. The following charts shows the return series for the dive clusters. There are clear differences based on the five different clusters (see the full paper for an overview of abnormal returns identified).

In summary, we identified that size and presumed motives of (large) Bitcoin transactions are part of the market structure. Market participants seem to monitor Bitcoin transactions and react accordingly. The results provide a basis for a multitude of further potential investigations. These may further relate to Bitcoin and could include characteristics such as trading volume or addresses of other market participants, such as miners. Also conceivable are investigations of other cryptocurrencies.

For more information, read the BRL Working Paper “Market Reaction to Large Transfers on the Bitcoin Blockchain – Do Size and Motive Matter?” here or contact the authors directly at ante@blockchainresearchlab.org.