Market Economics and Efficiency

Digital markets and products like cryptocurrencies possess various special properties, partly due to the comparatively short period of existence and low lower of regulation.

The BRL looks to assess market mechanisms and efficiency arising from these markets, such as determinants of returns or signs of fraudulent or manipulative behavior. The research projects aims to analysis of market mechanisms and the derivation of corresponding recommendations for action.

Publications:

The Influence of Stablecoin Issuances on Cryptocurrency Markets

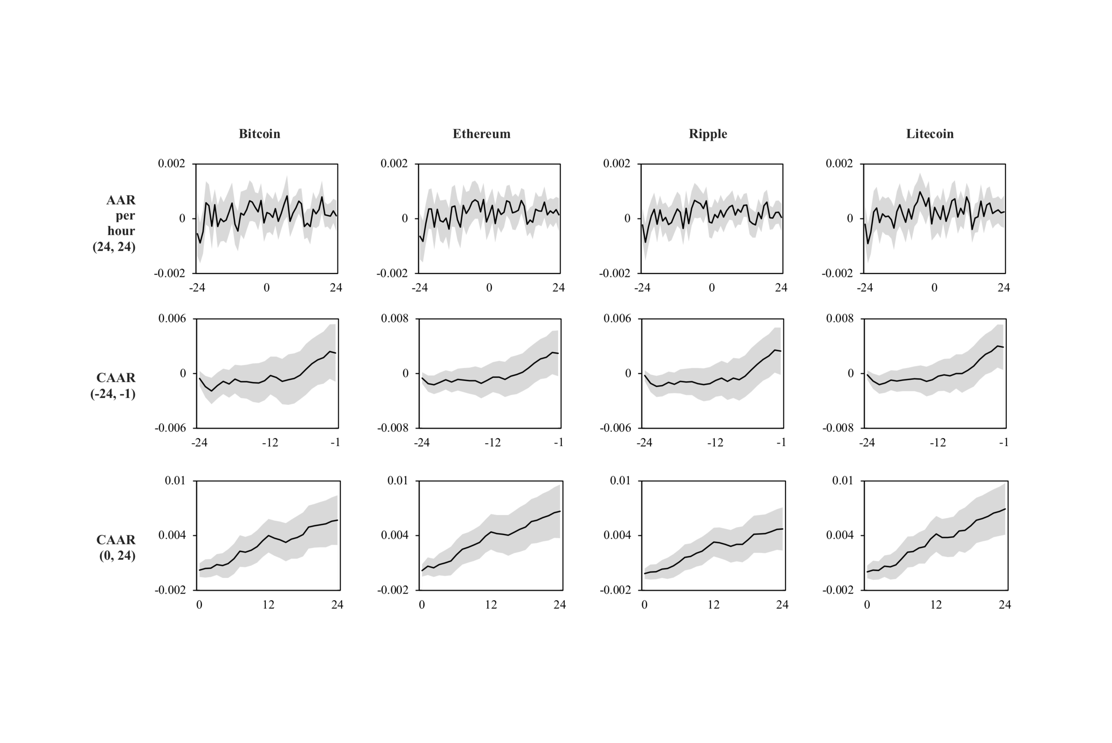

We analyze the influence of stablecoin issuances on the returns of major cryptocurrencies across 565 issuance events of $1 million or more for seven different stablecoins on four different blockchains between April 2019 and March 2020.

Bitcoin Transactions, Information Asymmetry and Trading Volume

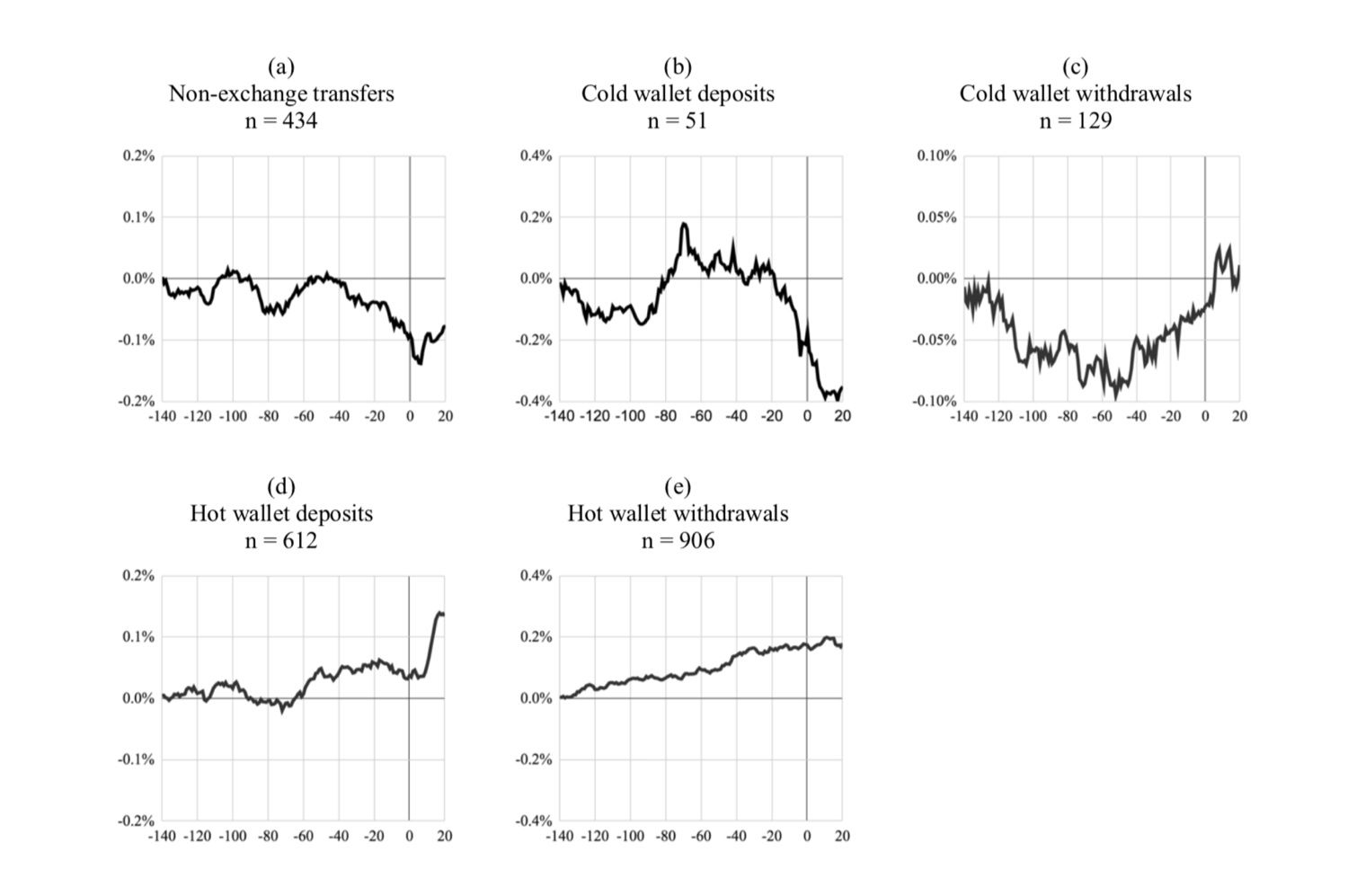

The underlying transparency of the Bitcoin blockchain allows transactions in the network to be tracked in near real-time. When someone transfers a large number of Bitcoins, the market receives this information and traders can adjust their expectations based on the new information.

Market Reaction to Large Transfers on the Bitcoin Blockchain – Do Size and Motive Matter?

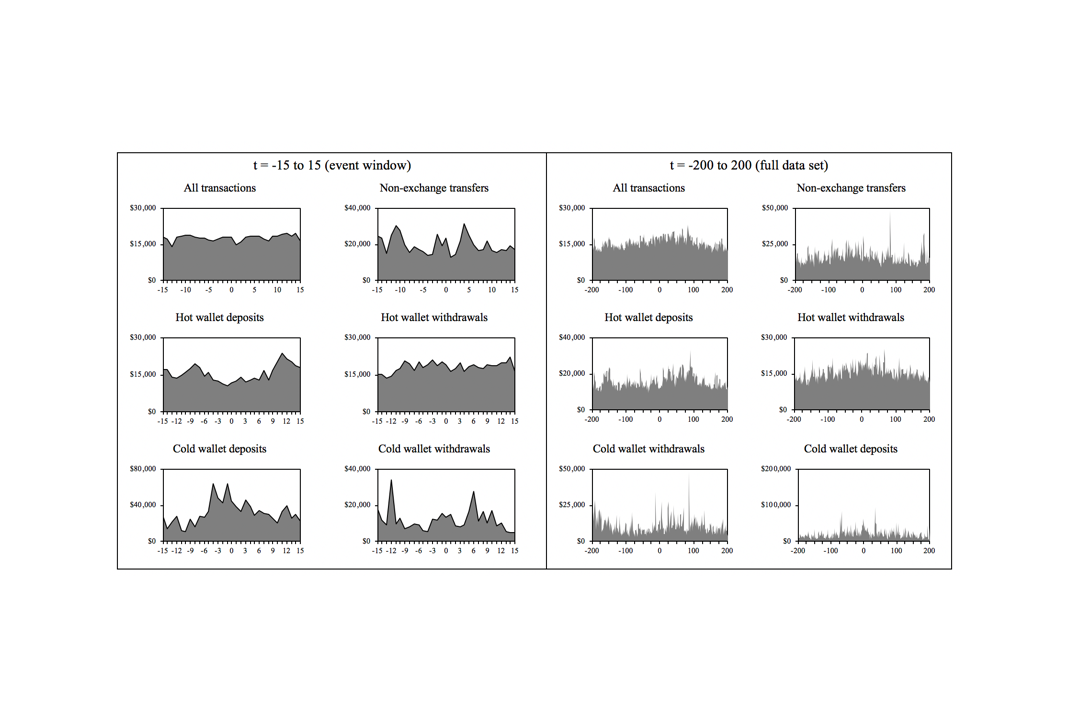

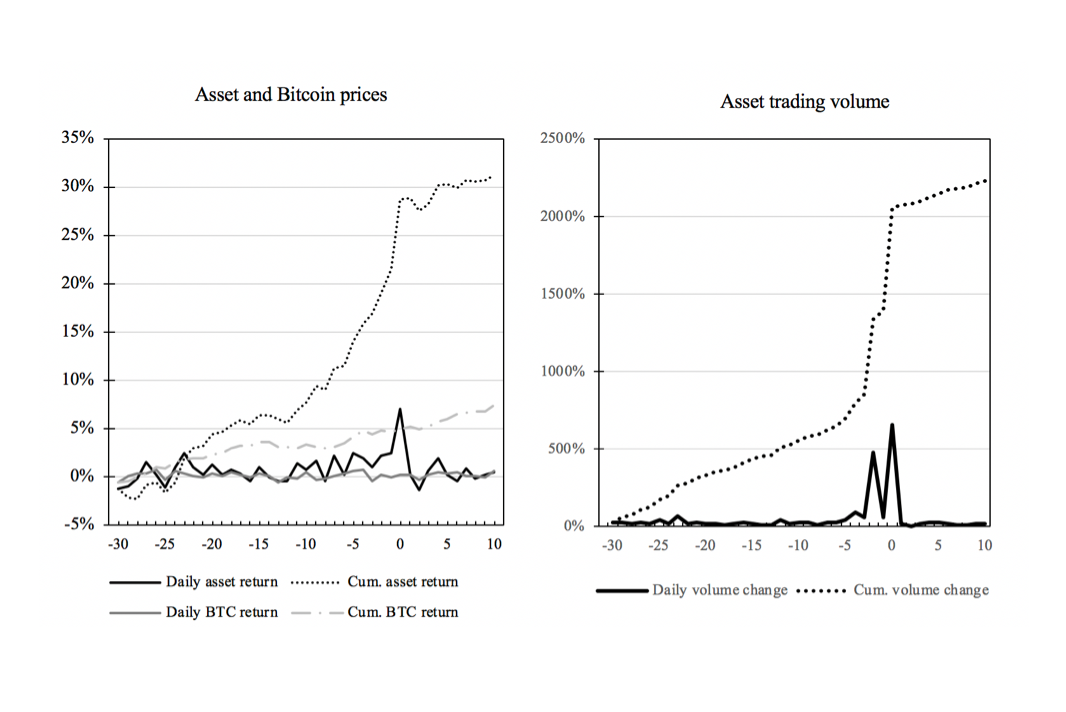

Cryptocurrency markets are often deemed inefficient. This paper explores how the market reacts to a specific form of public information: large Bitcoin transactions. The event study examines the price effects of 2,132 transactions involving at least 500 Bitcoins...

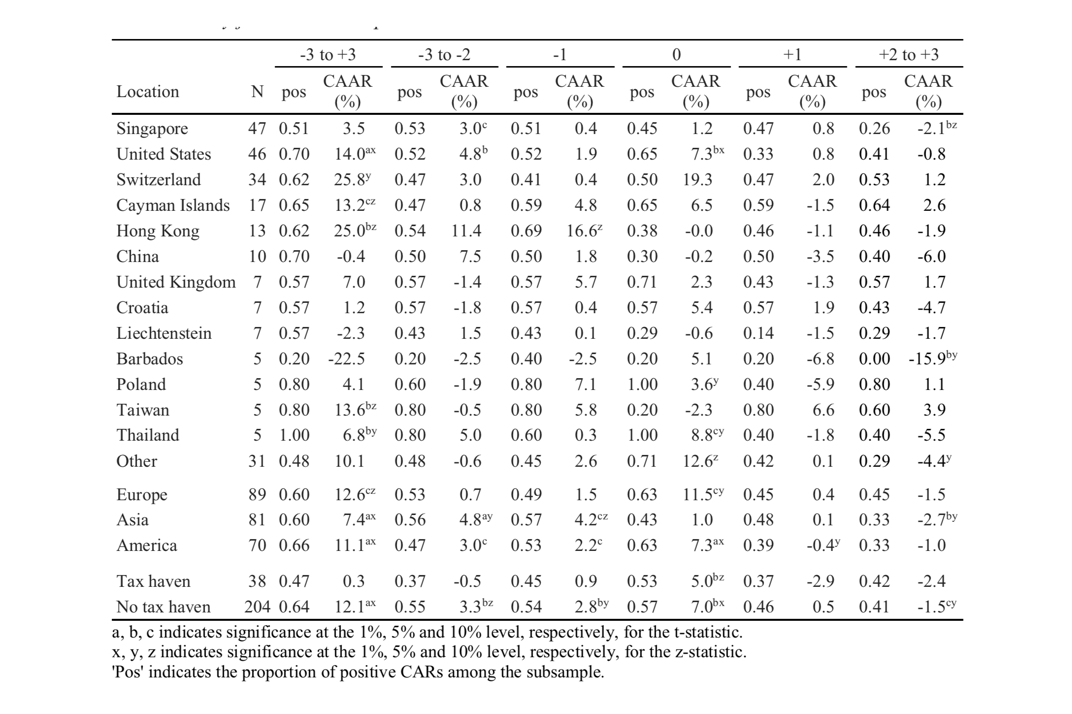

Effects of Initial Coin Offering Characteristics on Cross-listing Returns

This paper examines how initial coin offering (ICO) characteristics affect cross-listing returns, i.e. whether or not the available information is a valuable signal of quality. For this purpose, we analyze 250 cross-listings of 135 different tokens issued via ICOs and calculate abnormal returns for specific samples using event study methodology.

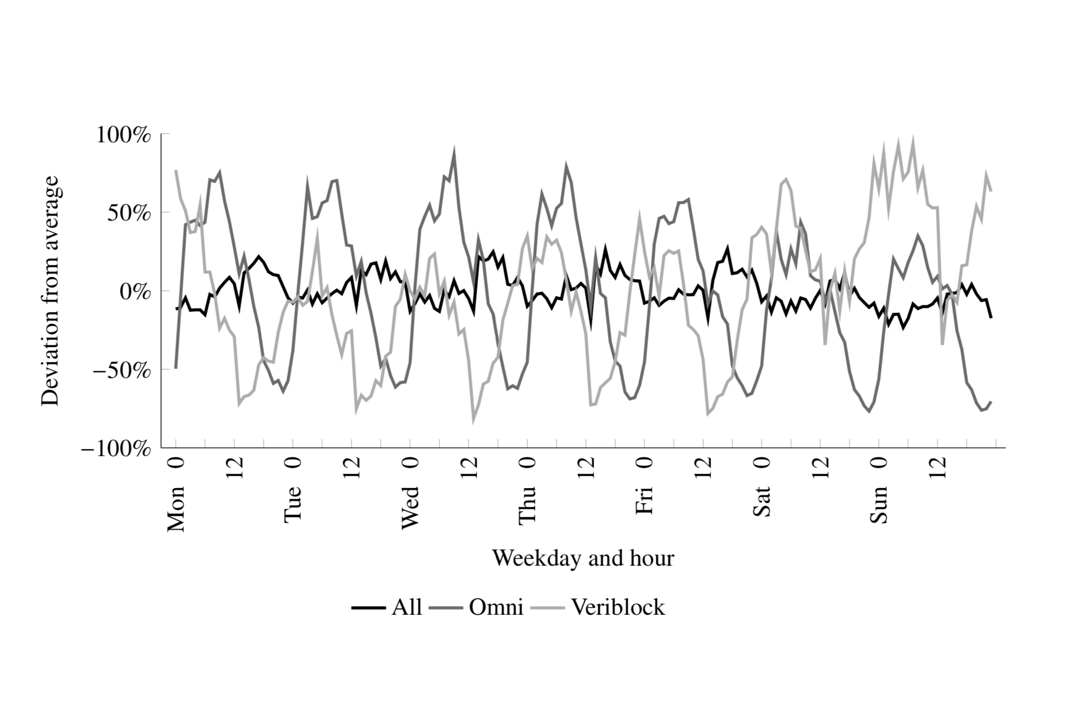

Dominating OP Returns: The Impact of Omni and Veriblock on Bitcoin

This paper provides an in-depth analysis of all OP Return transactions published on Bitcoin between September 14, 2018, and December 31, 2019. The 32.4 million OP Return transactions (22% of all Bitcoin transactions) published during...

Cross-listings of Blockchain-based Tokens issued through Initial Coin Offerings: Do Liquidity and specific Cryptocurrency Exchanges matter?

This study analyzes 250 exchange cross-listings of 135 different tokens issued through ICOs on 22 cryptocurrency exchanges...