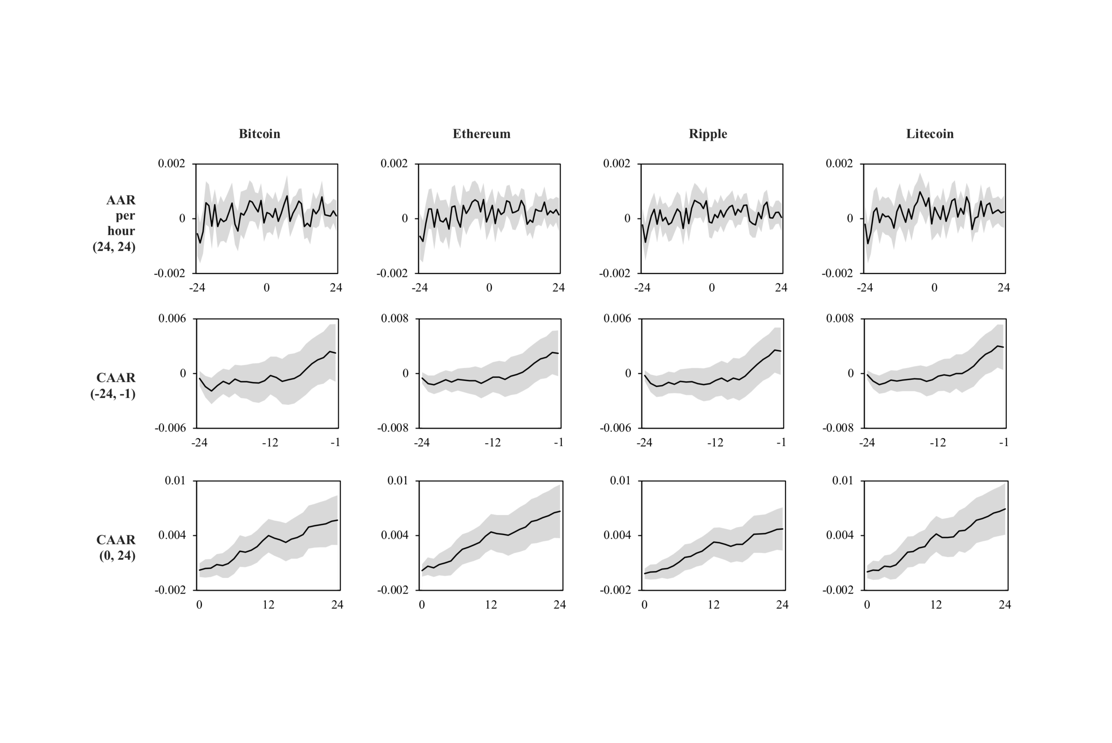

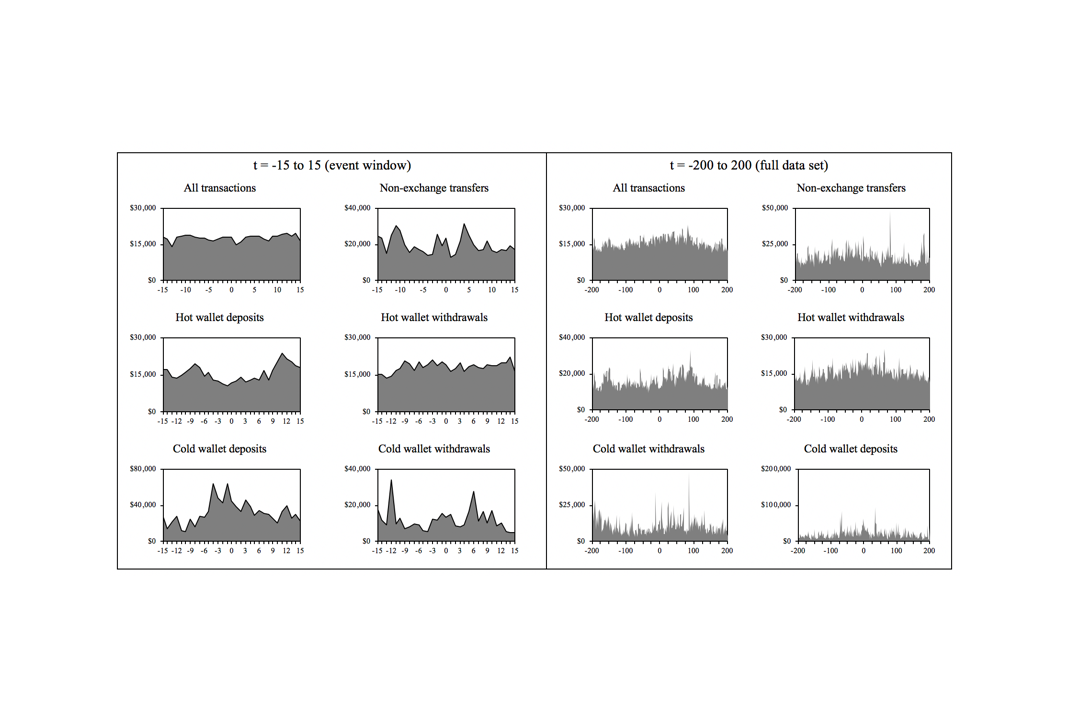

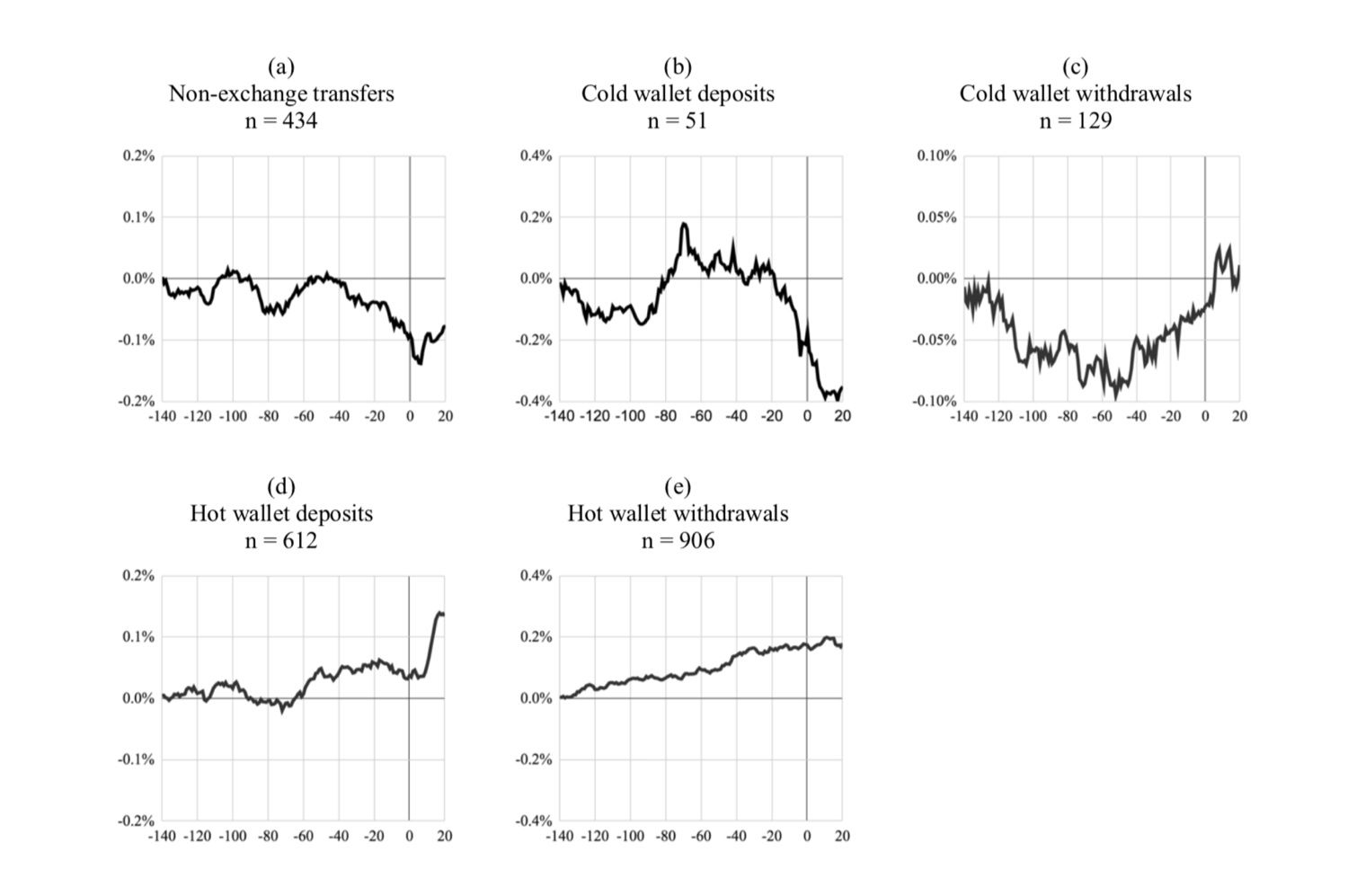

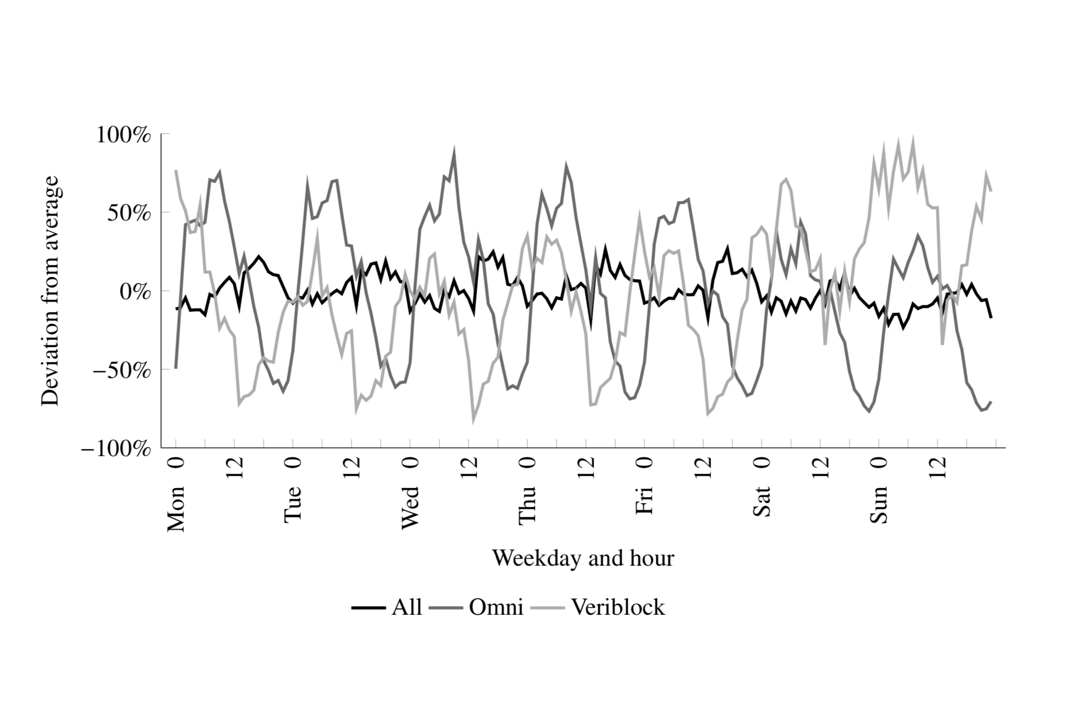

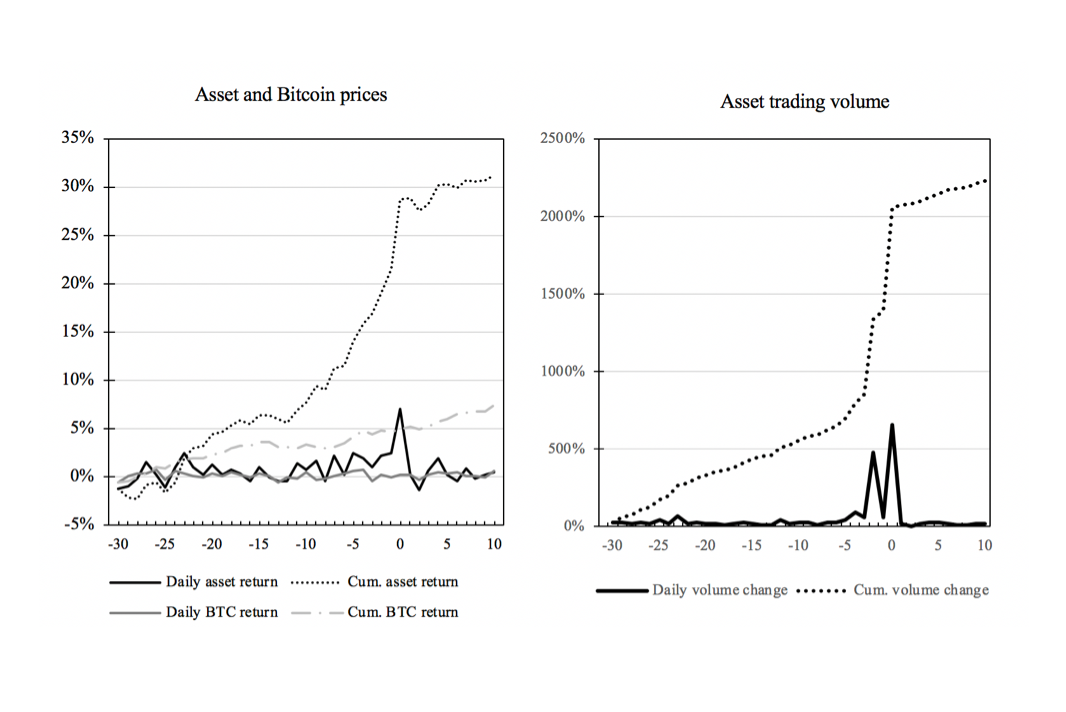

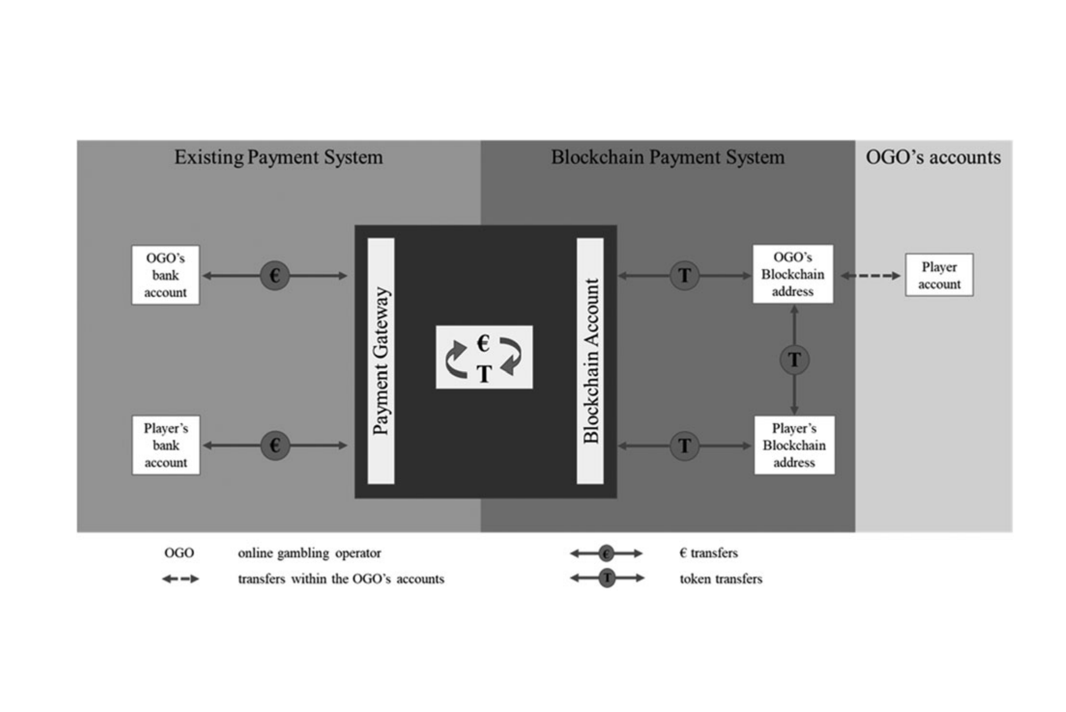

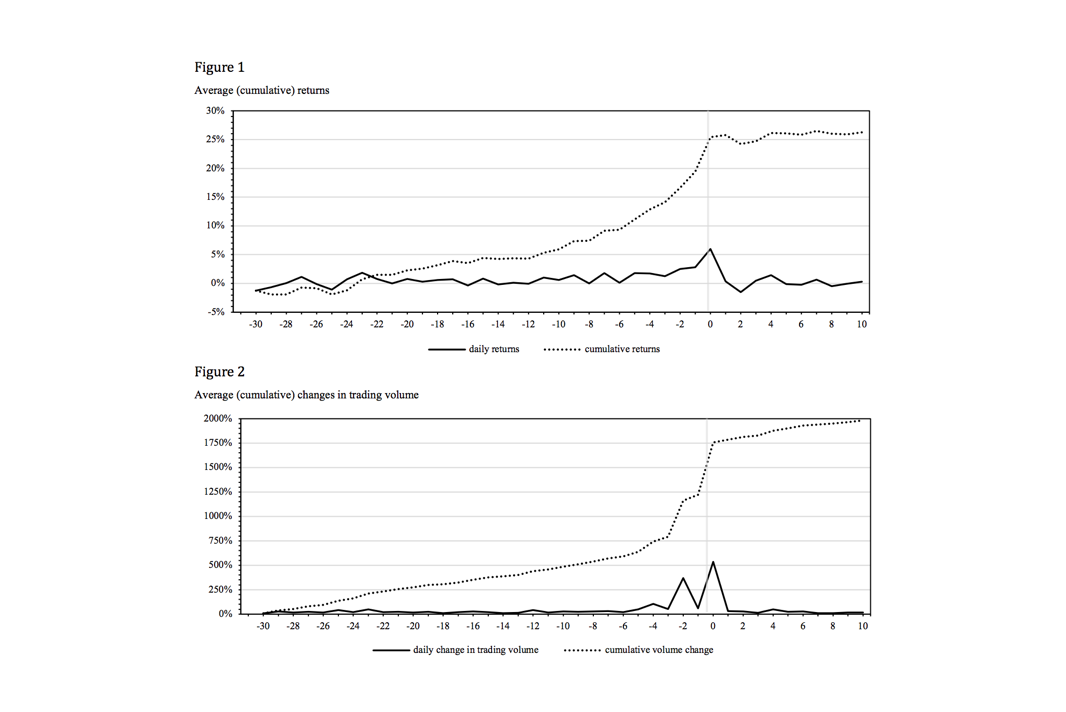

A sample of 1,587 stablecoin transfers of one million dollars or more is analyzed to find out how they affect Bitcoin returns and trading volume. We find effects on trading volume and returns in the hours around transfers. The findings illustrate the feedback effects between cryptocurrency markets and stablecoin usage.