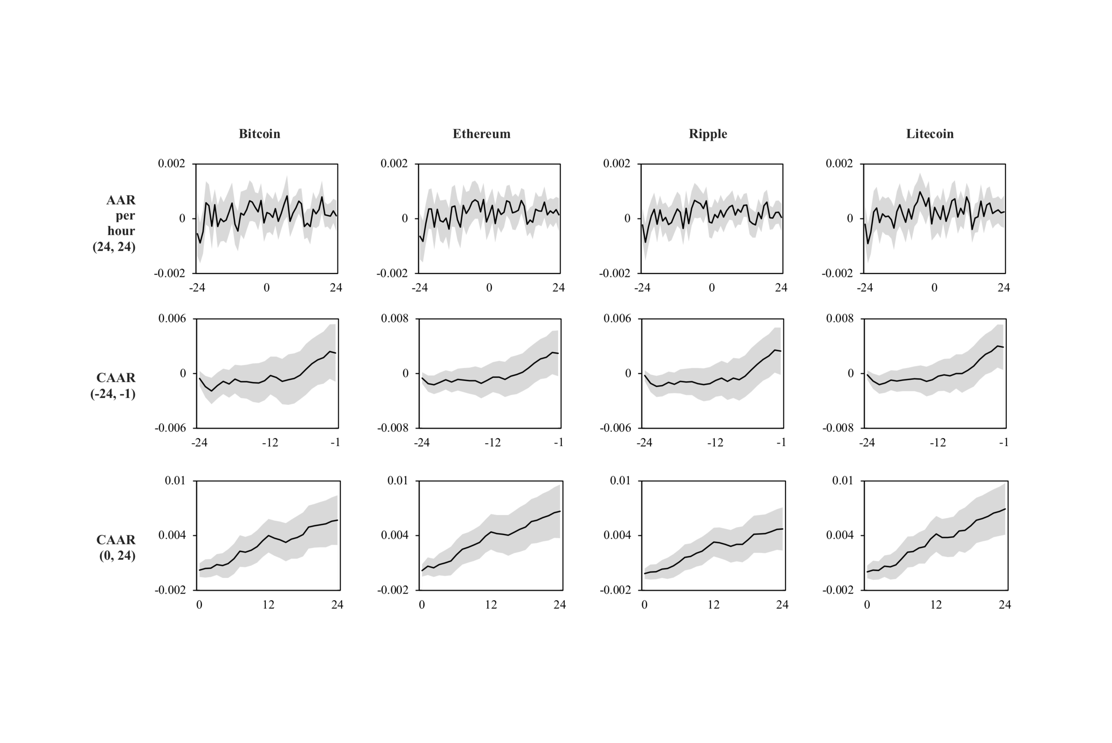

We analyze the influence of stablecoin issuances on the returns of major cryptocurrencies across 565 issuance events of $1 million or more for seven different stablecoins on four different blockchains between April 2019 and March 2020.

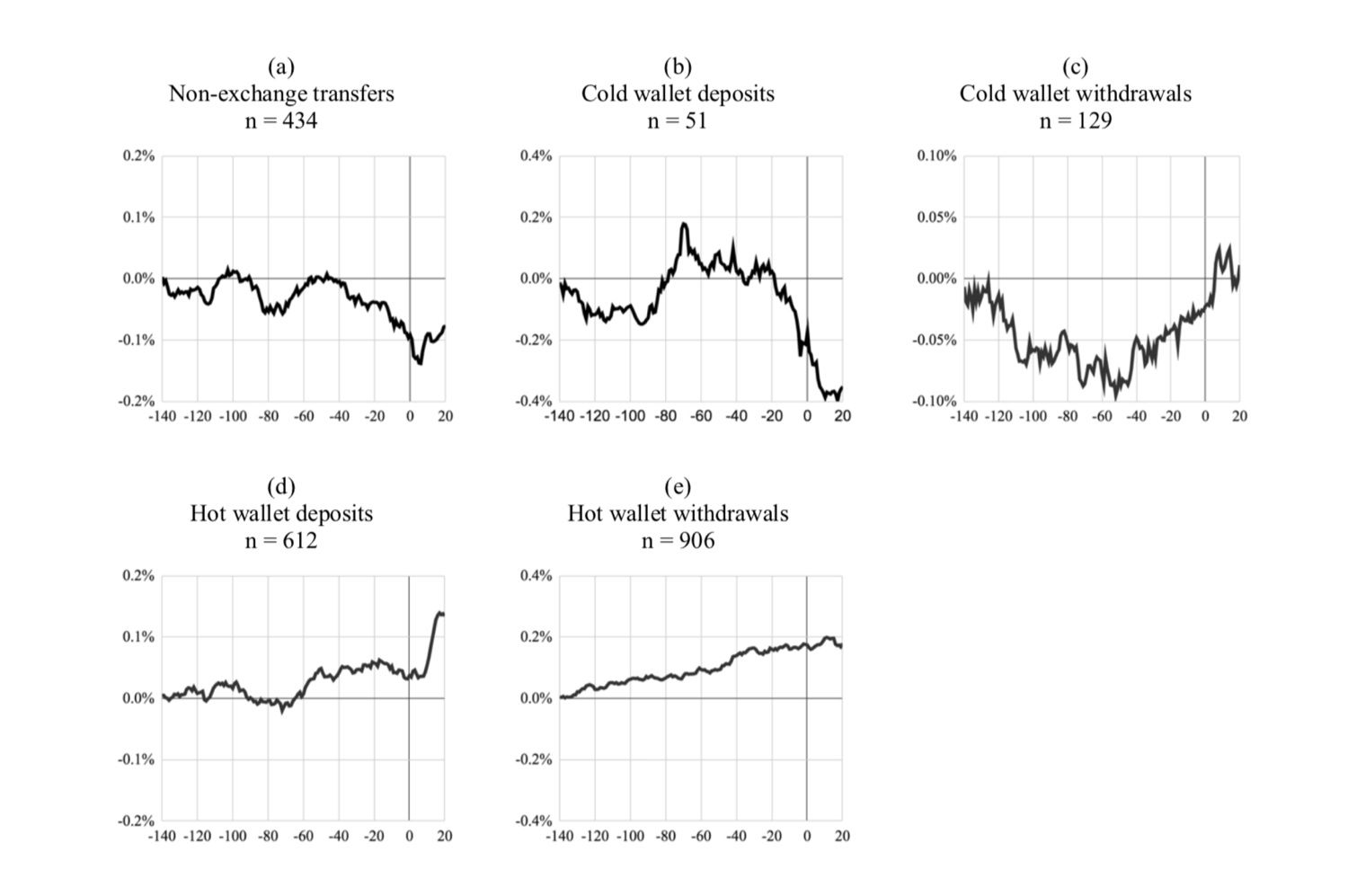

Market Reaction to Large Transfers on the Bitcoin Blockchain – Do Size and Motive Matter?

Blockchain Research Blog2020-11-10T07:46:03+02:00Cryptocurrency markets are often deemed inefficient. This paper explores how the market reacts to a specific form of public information: large Bitcoin transactions. The event study examines the price effects of 2,132 transactions involving at least 500 Bitcoins...

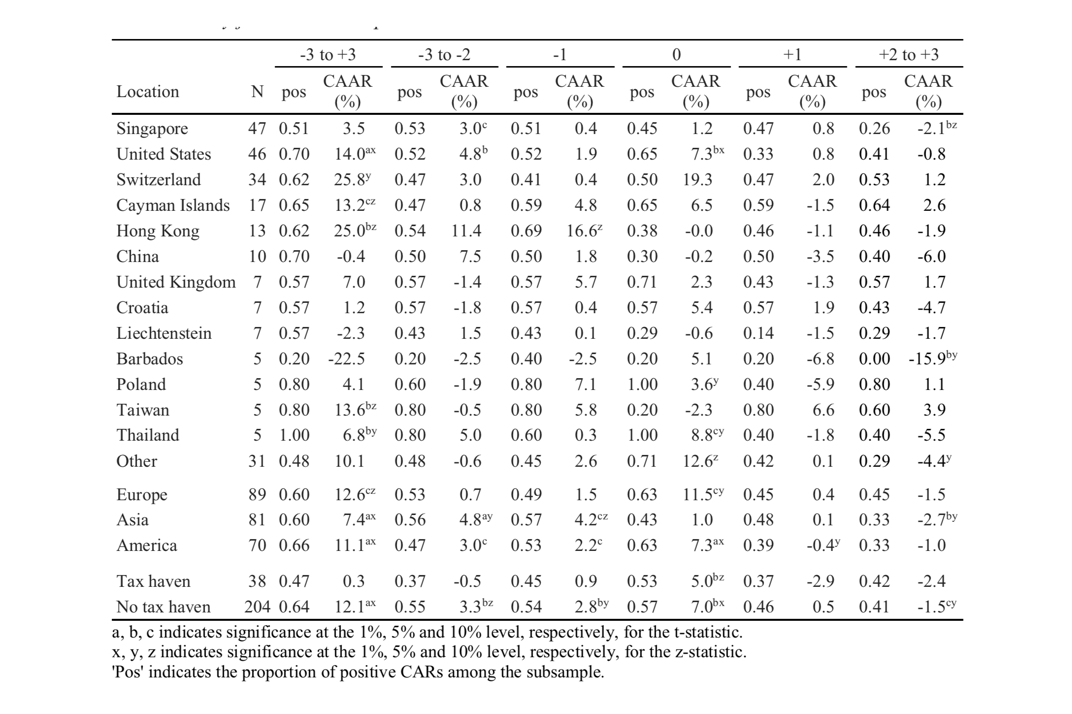

Effects of Initial Coin Offering Characteristics on Cross-listing Returns

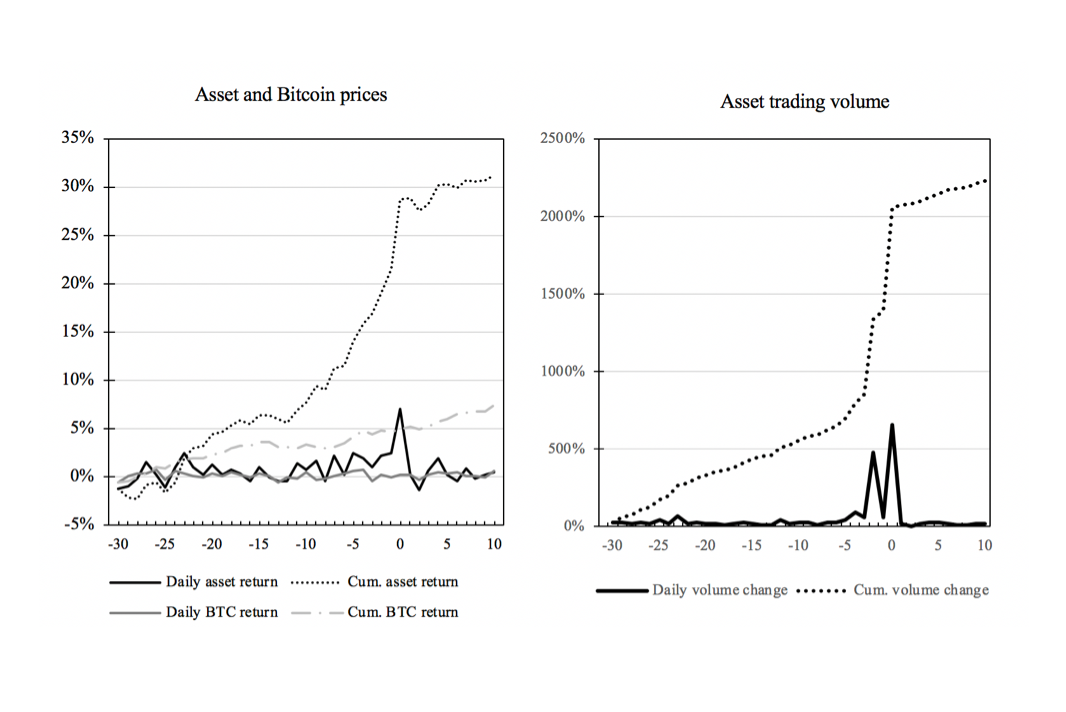

Blockchain Research Blog2020-11-10T07:51:55+02:00This paper examines how initial coin offering (ICO) characteristics affect cross-listing returns, i.e. whether or not the available information is a valuable signal of quality. For this purpose, we analyze 250 cross-listings of 135 different tokens issued via ICOs and calculate abnormal returns for specific samples using event study methodology.

Cross-listings of Blockchain-based Tokens issued through Initial Coin Offerings: Do Liquidity and specific Cryptocurrency Exchanges matter?

Blockchain Research Blog2020-11-10T07:59:05+02:00This study analyzes 250 exchange cross-listings of 135 different tokens issued through ICOs on 22 cryptocurrency exchanges...

Cheap Signals in Security Token Offerings (STOs)

Blockchain Research Blog2020-11-10T08:07:10+02:00Startups and small and medium-sized enterprises (SMEs) account for a significant share of the economy but are often constrained in their growth potential, as they have difficulty accessing capital markets...

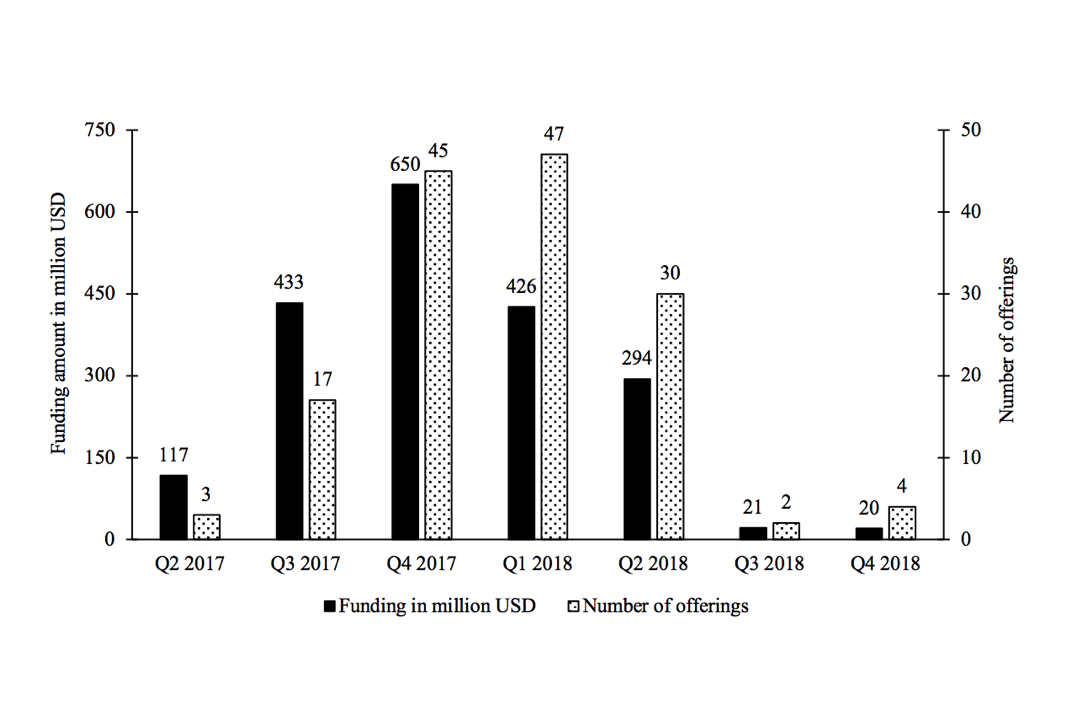

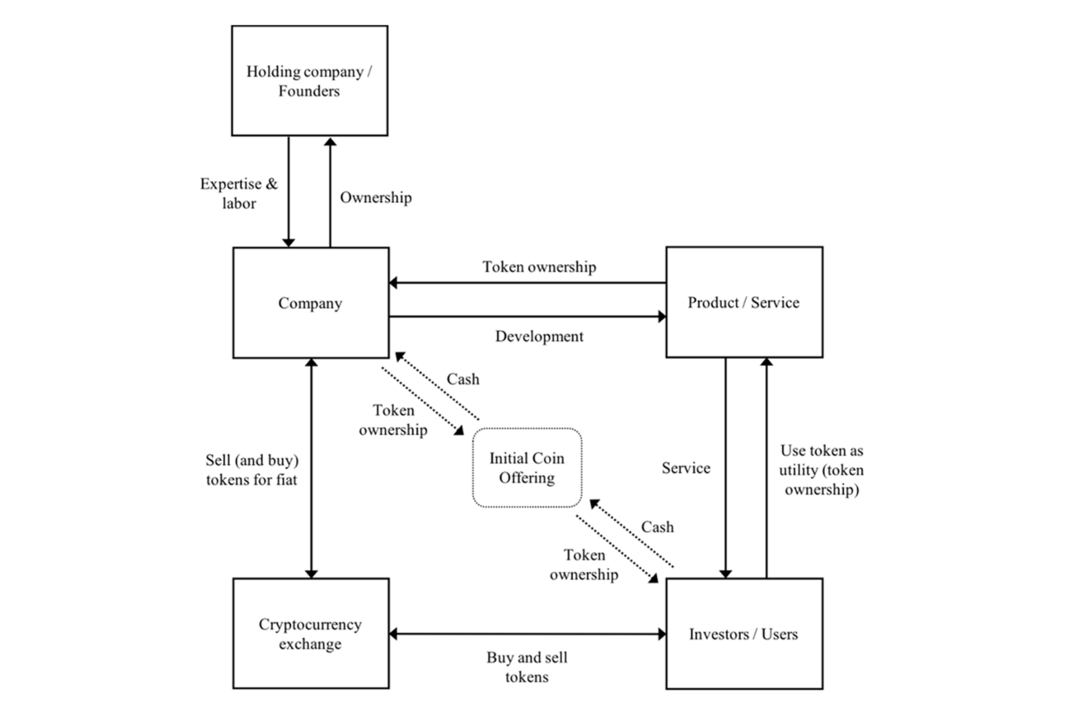

Blockchain-Based ICOs: Pure Hype or the Dawn of a New Era of Startup Financing?

Blockchain Research Blog2020-11-10T08:08:10+02:00This study explores the determinants of initial coin offering (ICO) success, where success is defined as the amount of capital a project could raise. ICOs are...