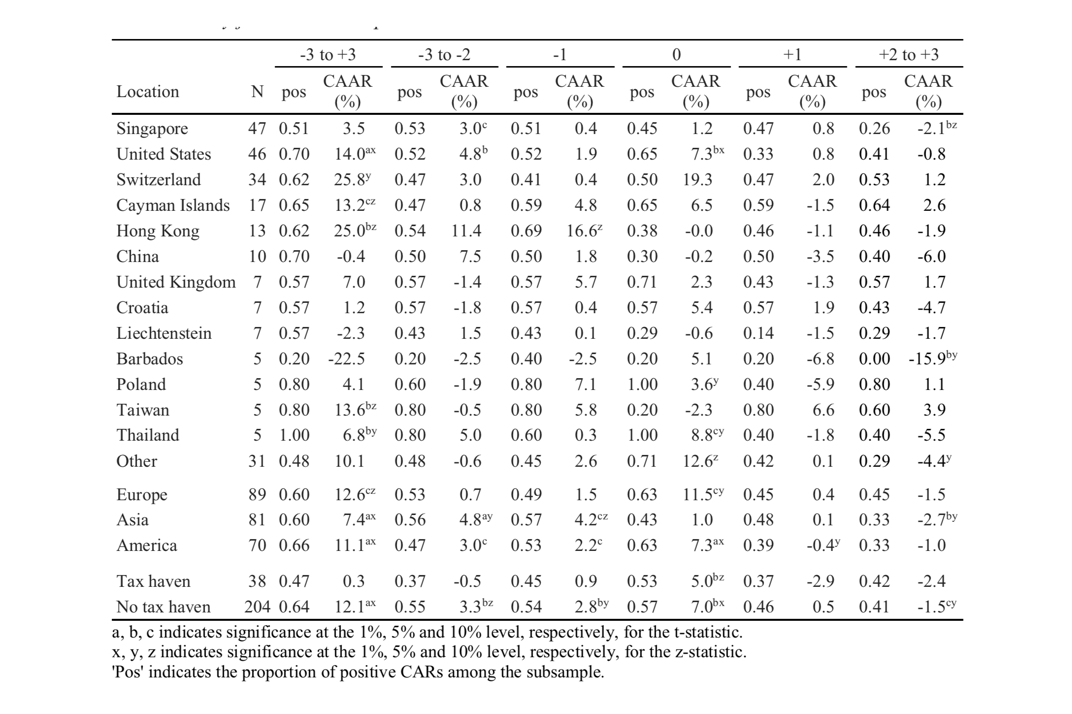

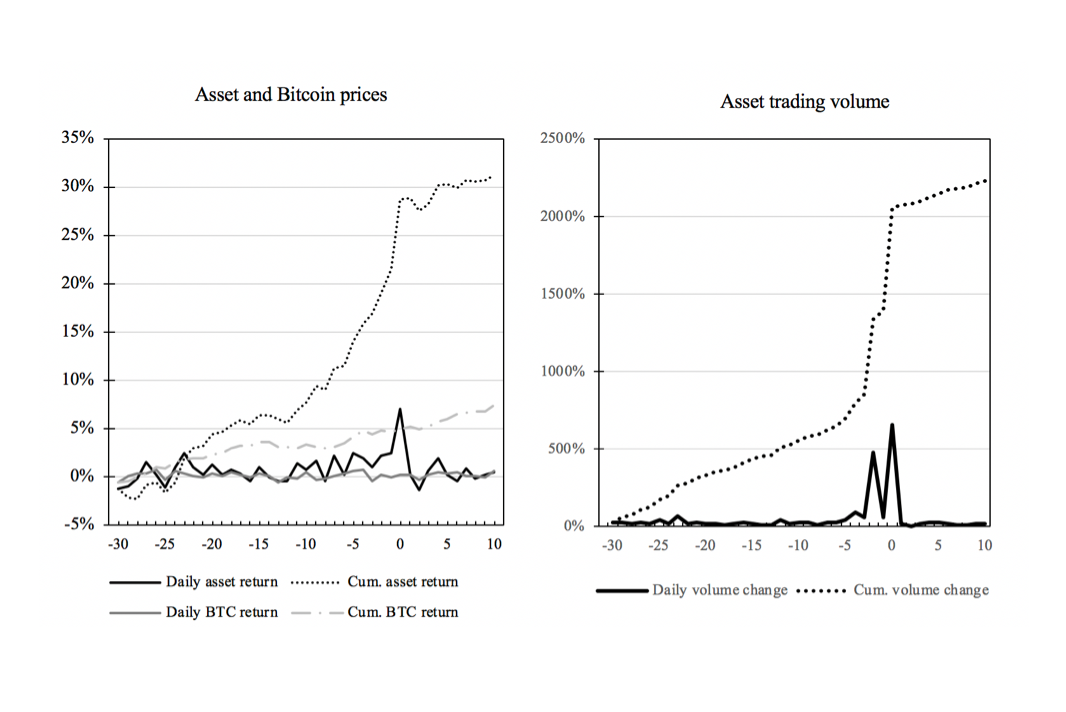

This paper examines how initial coin offering (ICO) characteristics affect cross-listing returns, i.e. whether or not the available information is a valuable signal of quality. For this purpose, we analyze 250 cross-listings of 135 different tokens issued via ICOs and calculate abnormal returns for specific samples using event study methodology.

Cross-listings of Blockchain-based Tokens issued through Initial Coin Offerings: Do Liquidity and specific Cryptocurrency Exchanges matter?

Blockchain Research Blog2020-11-10T07:59:05+02:00This study analyzes 250 exchange cross-listings of 135 different tokens issued through ICOs on 22 cryptocurrency exchanges...

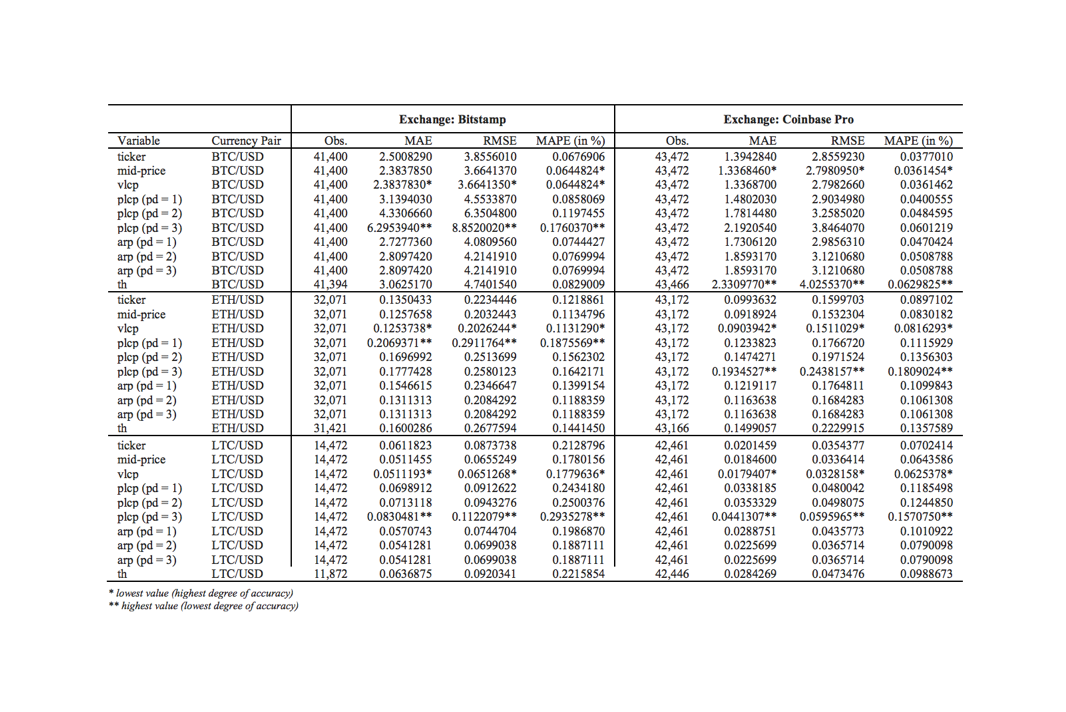

Discovering market prices: Which price formation model best predicts the next trade?

Blockchain Research Blog2020-11-10T08:05:37+02:00For most purposes of technical analysis, valuation metrics and many other relevant financial methods, the price of the last transaction is considered representative of...